Stock is the least liquid asset, so calculating how quickly it can sell demonstrates the company’s financial health. This guide on inventory turnover goes beyond simple inventory control processes. It provides business professionals with terms, formulas, ideal ratios, examples and expert guidance to help master inventory turnover. Thus, the inventory turnover rate determines how long it takes for a company to sell its entire inventory, creating the need to place more orders.

Inventory Turnover Ratio Formula

A sudden spike in demand might lead to rapid stock depletion, while a drop in interest might leave companies with excess inventory, both affecting turnover rates. Businesses with an optimal turnover rate often have a better cash flow and reduced storage costs, indicative of effective operations. Investors may also like to know the inventory turnover rate to determine how efficiently one company is performing against the industry average. This signals that from 2022 to 2024, Walmart increased its inventory turnover ratio. Dividing the 365 days in the year by 8.8 shows that Walmart turned over its inventory about every 41 days on average. Suppose Company B has total liabilities of 1 million dollar and shareholders’ equity of 500,000 dollars, resulting in a debt-to-equity ratio of 2.0.

Calculating Cost of Goods Sold Using Inventory Turnover Ratio

Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible. At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. Companies that move inventory relatively quickly tend to be the best performers in an industry.

What is the approximate value of your cash savings and other investments?

- Knowing how to calculate inventory turnover ratio starts with knowing your COGS, or cost of goods sold, as well as your average inventory.

- This ratio is calculated by dividing the cost of goods sold (COGS) by the average inventory for the period.

- Average inventory is essential in calculating inventory turnover because it represents the stock on hand relative to sales.

- While a high inventory turnover ratio generally indicates good business health, it can be too high in some situations.

- What counts as a “good” inventory turnover ratio will depend on the benchmark for a given industry.

It could also suggest that the company is holding onto obsolete or slow-moving inventory that may need to be written off or sold at a discount. This means that the business sold and replaced its inventory five times during a specific period. It indicates that the company is effectively managing its inventory, not holding too much, and successfully selling its products. Before we move forward, it’s important to understand the meaning of the term “inventory turnover ratio”. It shows the efficiency of a business in managing its inventory and how many times a company has sold and replaced its inventory during a specified period. A high ratio typically means good inventory management, while a low ratio might indicate excess inventory or poor sales.

Fungsi Inventory Turnover dalam Inventory Management

A DSI value of approximately 44 days means that, on average, it takes the company about 44 days to sell its entire inventory. There are also quantity discount bundles to consider if you’re selling bundles of the same product. Think of three-for-two deals in which customers receive more for their money. We believe everyone should be able to make financial decisions with confidence. Companies need to factor in these seasonal shifts to more accurately interpret their turnover rates. Companies need to make sure their high turnover is due to strong customer demand, rather than simply keeping too little stock on hand.

Raw Materials Inventory Turnover

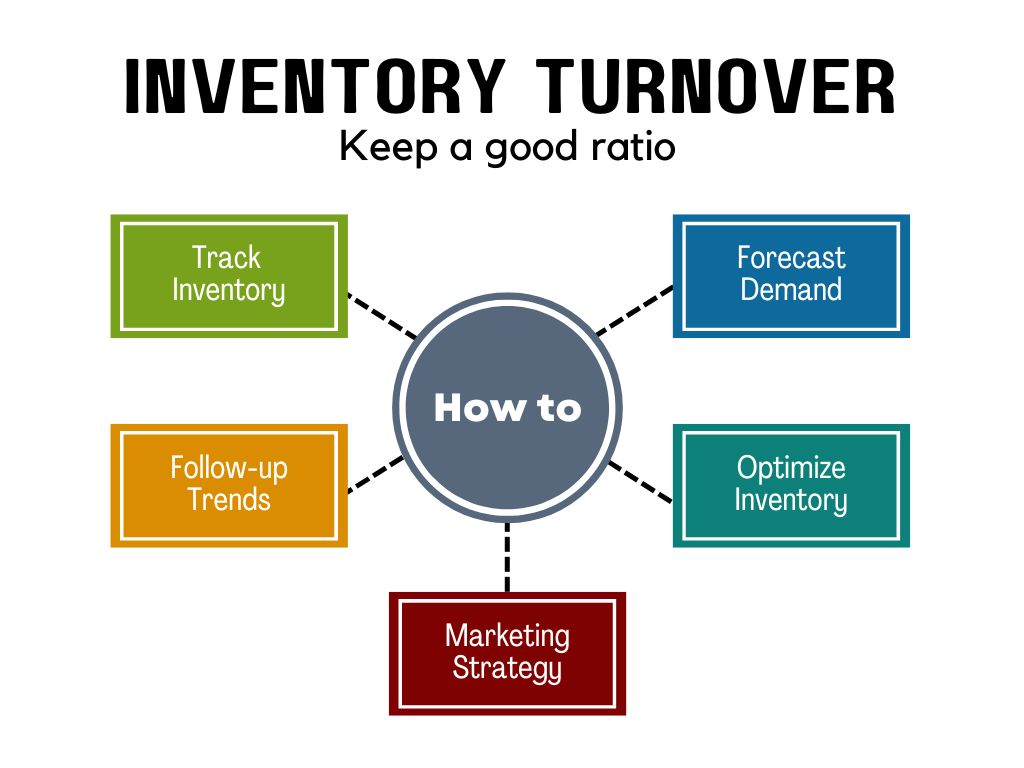

Similar to other financial ratios, the inventory turnover ratio is only one piece of information about a company’s ability to manage its inventory. A comparison to your industry can help you to determine if your turnover ratio is good or needs improvement. As shown in the example above for ABC Company, you would calculate the inventory turnover ratio by dividing $40,000 (COGS amount) by $15,000 (average inventory) for a total of 2.67. Advertising and marketing efforts are another great way to boost your inventory turnover ratio.

If your ITR doesn’t align with the benchmarks in your industry, it may point to flawed financial modeling. Perhaps your sales forecasts are too optimistic or your procurement costs too high. Such discrepancies can adversely affect your profit margin and should be corrected promptly. Tracking the ITR can help you identify errors in your financial modeling and to correct them.

Most industries have norms and clear expectations about what constitutes a reasonable rate of stock turnover. Unique to days inventory outstanding (DIO), most companies strive to minimize the DIO, as that means inventory sits in their possession for a shorter period. In this article, we’ll look into what inventory turnover is, how to calculate it, and the best practices for optimizing it to maximize profits. Ghost commerce is a business model focused on online operations without a visible storefront, using dropshipping, automation, and third-party fulfillment.

Accurate demand forecasting gives businesses a competitive edge, enabling them to meet customer demand without risking stock-outs. To understand the inventory turnover ratio, it’s essential to know the Cost of Goods Sold (COGS) formula, as it forms the basis for the inventory turnover calculation. Products that have sold well in the past do not necessarily sell well forever. Excess materials can also be sold back to the supplier – usually, they would be happy to buy them with a discount and sell them to another customer.

The company can consider adopting a more competitive pricing strategy, offering discounts, or introducing volume-based discounts for bulk purchases. A high value for inventory turnover usually accompanies a low gross profit figure. free invoice generator by paystubsnow This means that a company needs to sell a lot of items to maintain an adequate return on the capital invested in the company. This figure means it takes about four days for the department store to sell its stock overall.

By ordering parts only as needed, Toyota keeps its turnover high and limits unnecessary storage costs. Capture seasonal shoppers with trending costumes, spooky decor, and party supplies. Discover Halloween dropshipping strategies, popular products, and current consumer trends to make your store a go-to destination for Halloween shopping. Costco serves as a prime example in the retail industry regarding inventory turnover, consistently maintaining a ratio above 10, and often reaching up to 13, for over a decade.