This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Wolfram|Alpha can quickly and easily compute the present value of money, as well as the amount you would need to invest in order to achieve a desired financial goal in the future. Plots are automatically generated to help you visualize the effect that different interest rates, interest periods or future values could have on your result. If you want to calculate the present value of a stream of payments instead of a one time, lump sum payment then try our present value of annuity calculator here. This example shows that if the $4,540 is invested today at 12% interest per year, compounded annually, it will grow to $8,000 after 5 years.

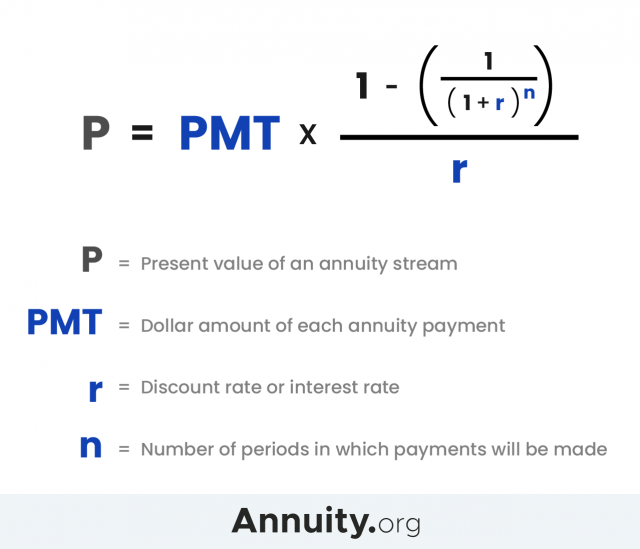

Formula to Calculate Present Value (PV)

This could be due to a number of factors such as volatility in the industry or market. Present value allows a solid basis where you can assess the level of fairness of any financial liabilities or benefits at a future date. So for example, a future cash rebate discounted to present value could or could outweigh the downsides of having a higher potential purchase price. The same calculation can be applied to 0% financing when someone buys a car from a dealership. Excel is a powerful tool that can be used to calculate a variety of formulas for investments and other reasons, saving investors a lot of time and helping them make wise investment choices. When you are evaluating an investment and need to determine the present value (PV), utilize the process described above in Excel.

Present Value of a Future Sum

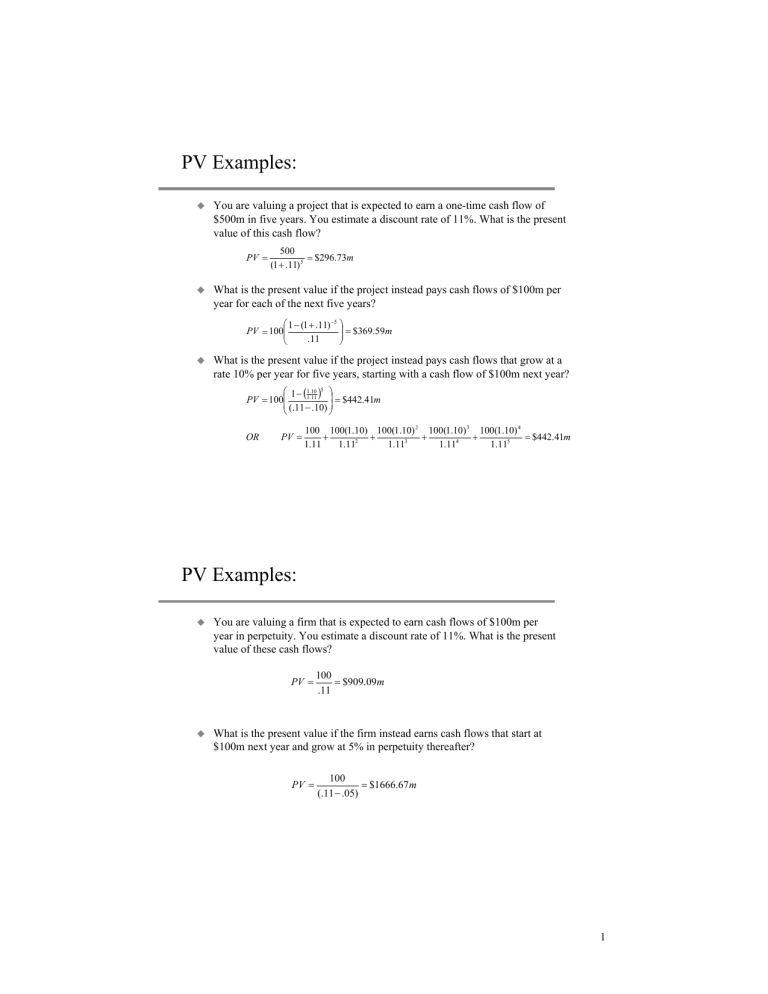

Present value, also called present discounted value, is one of the most important financial concepts and is used to price many things, including mortgages, loans, bonds, stocks, and many, many more. Present value is important in order to price assets or investments today that will be sold in the future, or which have returns or cash flows that will be paid in the future. Because transactions take place in the present, those future cash flows or returns must be considered by using the value of today’s money. The discount rate is actually a proxy for risk, and therefore, it’s how we penalise future cash flows for their level of risk. In time value of money calculations, the interest rate can also be referred to as a rate of return, opportunity cost, or discount rate.

Ask Any Financial Question

So make sure that you use other metrics alongside present value to get the best idea possible. A higher present value is better than a lower one when assessing similar investments. One key point to remember for PV formulas is that any money paid out (outflows) should be a negative number, while money in (inflows) is a positive number.

If equations and / or math freaks you out, then it’s time to get past your fear. If you’re just looking for the Present Value formula, we’ve included it just below. The percentage earned over time on money because time decreases its value. Given a higher discount rate, the implied present value will be lower (and vice versa).

- What that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%.

- We’ll assume a discount rate of 12.0%, a time frame of 2 years, and a compounding frequency of one.

- So let’s go ahead now and step things up just a little bit by considering the case with multiple cash flows.

- It is practically compound interest calculation done backwards to find the amount you have to invest now to get to a desired amount in the specified point in the future.

- The discount rate is highly subjective because it’s simply the rate of return you might expect to receive if you invested today’s dollars for a period of time, which can only be estimated.

Why You Can Trust Finance Strategists

The discount rate is highly subjective because it’s simply the rate of return you might expect to receive if you invested today’s dollars for a period of time, which can only be estimated. Using present value is a quick and easy way to assess the present and future value of an investment. Investors can use the calculation to get a quick overview of the situation and whether it would be a good idea to invest money today, assuming a consistent annual rate of return. And it’s called the discount rate because this is the rate that we’re using to discount the future cash flow. It’s still fundamentally about “discounting” those future cash flows back to the present.

The present value formula applies a discount to your future value amount, deducting interest earned to find the present value in today’s money. Imagine someone owes you $10,000 and that person promises to pay you back after five years. If we calculate the present value of that future $10,000 with an inflation rate of 7% using the net present value calculator above, the result will be $7,129.86. In addition, there is an implied interest value to the money over time that increases its value in the future and decreases (discounts) its value today relative to any future payment. Net present value (NPV) is the value of your future money in today’s dollars.

So, let’s look at a formula you can use to determine the present value today of money to be received in the future. We will need to take the Future Value (FV) formula and modify it to get the Present Value (PV) equation. Present value is a way of representing the current value of a future sum of money or future cash flows. While useful, it is dependent on making good assumptions on future rates of return, assumptions that become especially tricky over longer time horizons. PV helps investors determine what future cash flows will be worth today, allowing them to understand the value of an investment and thereby choose between different possible investments.

Calculating present value is important when it comes to determining the potential value of an investment. For example, if you wanted to figure out the present value of an amount that you’re expecting to receive in three years’ time, place the number “3” for the “n”. Figure out the interest rate that you are expecting to receive between now and the future.

It is used both independently in a various areas of finance to discount future values for business analysis, but it is also used as a component of other financial formulas. Below is more information about present value calculations so you understand the factors that affect your money and how to use this calculator properly. This Present leveraged loan funds Value Calculator makes the math easy by converting any future lump sum into today’s dollars so that you have a realistic idea of the value received. You must always think about future money in present value terms so that you avoid unrealistic optimism and can make apples-to-apples comparisons between investment alternatives.