Since the future can never be known there is always an element of uncertainty to the calculation despite the the scientific accuracy of the calculation itself. For example, present value is used extensively when planning for an early retirement because you’ll need to calculate future income and expenses. Net present value is considered a standard way of making these investment decisions. The purchasing power of your money decreases over time with inflation, and increases with deflation. You could run a business, or buy something now and sell it later for more, or simply put the money in the bank to earn interest.

Present Value of a Perpetuity (t → ∞) and Continuous Compounding (m → ∞)

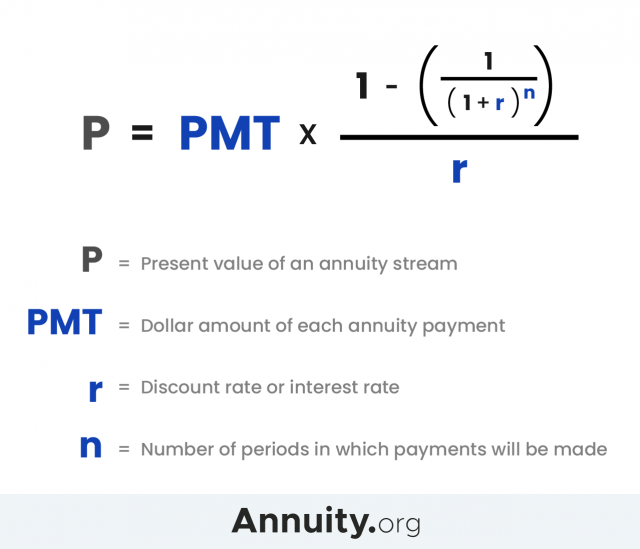

The effects of compound interest—with compounding periods ranging from daily to annually—may also be included in the formula. Plots are automatically generated to show at a glance how present values could be affected by changes in interest rate, interest period or desired future value. This is a great example of the time value of money concept in action demonstrated through simple present value calculations. The present value of the annuity decreases the more time it takes to pay off if the future value and rate of return staying the same.

How to know if a present value of an investment is good or bad?

This equation is comparable to the underlying time value of money equations in Excel. The higher the discount rate you select, the lower the present value will be because you are assuming that you would be able to earn a higher return on the money. In many cases, investors will use a risk-free rate of return as the discount rate. Treasury tax calculator and refund estimator 2020 bonds, which are considered virtually risk-free because they are backed by the U.S. government. Always keep in mind that the results are not 100% accurate since it’s based on assumptions about the future. The calculation can only be as accurate as the input assumptions – specifically the discount rate and future payment amount.

What is the approximate value of your cash savings and other investments?

- That’s how we incorporate the risk of not earning future expectations, into our estimate for the present value.

- A mentioned, the discount rate is the rate of return you use in the present value calculation.

- Understanding this discounted calculation is important to gaining insight into the relationships between time, risk, opportunity cost, and value.

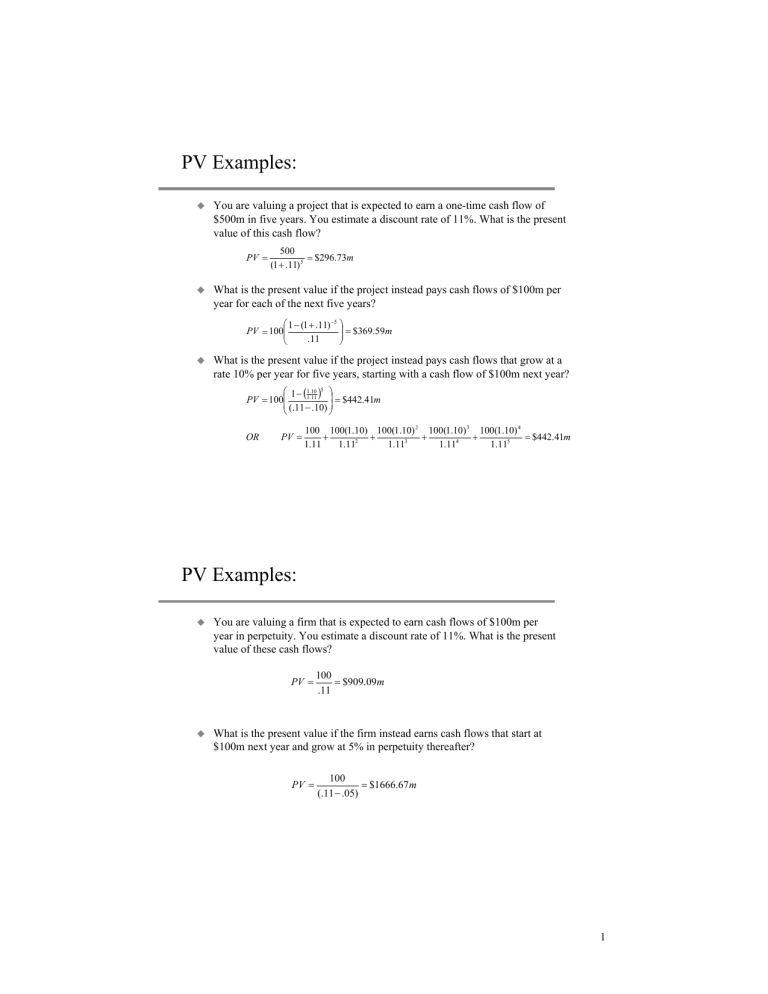

- Let us take another example of a project having a life of 5 years with the following cash flow.

- Similar to future value tables, present value tables are based on the mathematical formula used to determine present value.

We can use a formula to help us determine a future value when the calculations get more complex with more years. Let’s start with a formula that helps us determine the value of an amount of money at a future date, or the future value formula. Compound interest is like the secret power of a superhero because it gives you powerful growth of your savings over time. Compound interest is when you earn interest every year not only on the original amount you deposit into an account, but you also earn interest on interest! Let’s look at an example to see how compound interest and different interest rates, the percentage at which money grows over a specified period, impact the growth of your money over time.

Calculator Use

In other words, to maintain the same present value the interest rate would need to increase parallel to the increasing number of years one is locked into an investment. In short, a greater discount rate is required to justify a longer term investment decision. Present value calculator is a tool that helps you estimate the current value of a stream of cash flows or a future payment if you know their rate of return.

You divide 72 by the return you would receive to find the number of years. Thus, the $10,000 cash flow in two years is worth $7,972 on the present date, with the downward adjustment attributable to the time value of money (TVM) concept. Using those assumptions, we arrive at a PV of $7,972 for the $10,000 future cash flow in two years. The present value (PV) formula discounts the future value (FV) of a cash flow received in the future to the estimated amount it would be worth today given its specific risk profile.

Present value can be calculated relatively quickly using Microsoft Excel. For example, if you are due to receive $1,000 five years from now—the future value (FV)—what is that worth to you today? Using the same 5% interest rate compounded annually, the answer is about $784. The word “discount” refers to future value being discounted back to present value. This formula is commonly used in corporate finance and banking, but is equally useful in personal or household financial calculations.

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own.

The present value of a single amount formula is most often used to determine whether or not an investment opportunity is good. To solve the problem presented above, first, determine the future value of $1,000 invested at 12%. Based on this result, if someone offered you an investment at a cost of $8,000 that would return $15,000 at the end of 5 years, you would do well to take it if the minimum rate of return was 12%. Since there are no intervening payments, 0 is used for the “PMT” argument.

Due to the relationship between future and present values, the present value table is the inverse of the future value table. In present value situations, the interest rate is often called the discount rate. Some individuals refer to present value problems as “discounted present value problems.” The amount you would be willing to accept depends on the interest rate or the rate of return you receive. For example, suppose you want to know the value today of receiving $15,000 at the end of 5 years if a rate of return of 12% is earned.

The net present value calculator is easy to use and the results can be easily customized to fit your needs. You can adjust the discount rate to reflect risks and other factors affecting the value of your investments. What that means is the discounted present value of a $10,000 lump sum payment in 5 years is roughly equal to $7,129.86 today at a discount rate of 7%. As shown above, the future value of an investment can be found by using the present value of a single amount formula and adjusting for compound interest.